Online Bank Account | Personal Banking | Santander Bank - Santander

The best financial tools and advice for every need.

Invest with confidence

Santander Investment Services* offers a wide range of solutions that provide the guidance you need to set investment goals and the tools you need to achieve them. Start working with a Financial Advisor today.

News and updates

Recognizing fraud- and how to fight back

See how Santander helps you take charge of your security.

Learn moreLet's meet in person

Schedule one-on-one time with a banker.

Schedule one-on-one time with a banker.

Santander mobile banking for anywhere convenience

Make Mobile Check Deposits, set up Alerts, manage cards, and more, all from the Santander Mobile Banking App. It’s the simplest, most secure way to manage your money on the go.

Scan QR code to open app. ![]()

Freedom with

Santander PROTECHTION

Santander PROTECHTION

A banking experience designed around your individual goals

Your dedicated Relationship Banker can provide you with access to our best rates on deposits, as well as preferred pricing on lending and investment products*.

Community-oriented action

Our support for inclusive, sustainable growth helps customers and communities build paths to prosperity today, tomorrow, and for the future.

68,000+

Volunteer hours

$33.3M

Given in support to nonprofits

400+

nonprofits supported

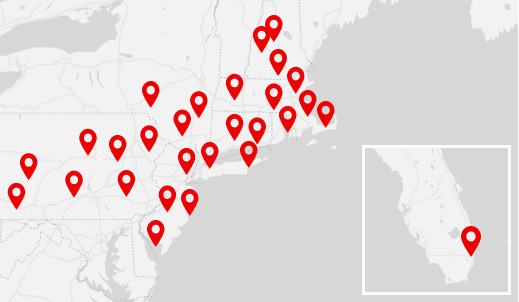

Find Us

Find Us

1Get $400 when you open a new Santander Select® Checking, Simply Right® Checking, or Santander® Private Client Checking account ($25 minimum opening deposit on all) by 12/31/2024 and have direct deposits totaling $5,000 or more post to this account within the first 90 days. The 90-day period begins the day of account opening, unless the account is opened on a weekend or holiday, in which case the period begins on the first business day after account opening. Offer is transferable until redeemed by the addressee and we reserve the right, in our sole discretion, to limit the number of times this Promotion Code may be used. You must be 18 years or older. Offer is not available if any account owner is a current checking customer of Santander or had a Santander checking account in the last 12 months prior to account opening. Offer cannot be combined with any other bonus offer. Promotion Code must be entered at new account opening to be eligible for this offer, and cannot later be added to an account, or changed, unless it is presented and applied within 14 days of account opening. The account must remain open in an eligible account type until payment of bonus, which will occur within 30 days thereafter. In addition, the account must remain open and in good standing to be bonus eligible. Bonus is considered interest and will be reported to the IRS on Form 1099-INT. If multiple accounts are opened with the same signer, or maintained with the same ownership as of the date the bonus is payable, only one account will be eligible for the bonus. For new checking account customers only. Offer is only available to residents of NH, MA, RI, CT, DE, NY, NJ, PA, or FL (Florida Eligibility: This offer is only eligible online in ZIP codes within Miami Dade, Monroe, and Broward Counties, including ZIP code 34141). As of 09/01/2024, the Annual Percentage Yield (APY) for Santander Select® Checking is 0.01%, and Santander® Private Client Checking is 0.03%. Rates may change at any time and after the account is opened. Fees may reduce earnings. Offer expires 12/31/2024. This offer is subject to change at any time. Offer is only valid with use of a Promotion Code. Promotion of this offer may end at any time.

2Qualifying Direct Deposits include your paycheck, pension, government benefits (such as Social Security), or other eligible regular monthly income from your employer or the government electronically deposited to your checking account. Direct Deposits do not include teller deposits, wire transfers, debit card transfers, ATM, Online and Mobile Banking transfers or deposits, person to person transfers (such as Zelle® or Venmo), or a merchant advancing payroll using a debit card.

Santander Securities LLC U.S. registered representatives may only conduct business with residents of the states in which they are properly registered. Please note that not all of the investments and services mentioned on this website are available in every state.

| INVESTMENT AND INSURANCE PRODUCTS ARE: | |||||

| NOT FDIC INSURED | NOT BANK GUARANTEED | MAY LOSE VALUE | |||

| NOT INSURED BY ANY FEDERAL GOVERNMENT AGENCY | NOT A BANK DEPOSIT | ||||

! Should be at bottom of page !

Equal Housing Lender - Member FDIC

Equal Housing Lender - Member FDIC