Specialty Business Accounts IOLTA and Escrow | Santander Bank - Santander

Our available specialty accounts

Interest on Lawyers' Trust Accounts (IOLTA)

IOLTA is a proven solution for attorneys who manage short-term funds for their customers. Our accounts meet state IOLTA requirements for receipt of interest on attorney accounts.- Use your monthly statements for a record of deposits and disbursements, and view interest earned that was remitted to the state.

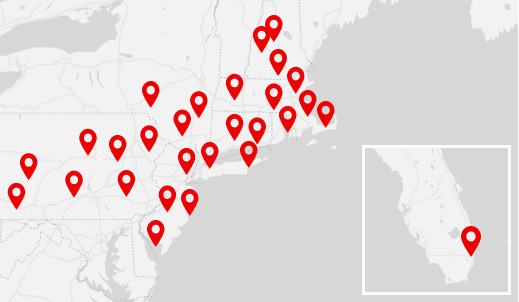

- IOLTA accounts are available in every state within our footprint: NY, PA, NJ, RI, CT, DE, MA, NH, FL, and Washington, D.C.

Escrow accounts

Many businesses rely on escrow accounts to organize and manage segregated client assets.- Hold funds for a single client or use an Escrow Master-Sub Relationship for multiple client accounts.

- Use your consolidated monthly statements to keep track of client deposits and earned interest.

- Reduce your administrative burdens with 1099 IRS tax forms automatically issued to clients at year-end.

- Securely manage escrow sub accounts using our self-service portal to open, close, and make payments to the subaccounts online.

The flexibility you need to do business while you're busy

We're here to support your unique small business

Forthcoming with our customers, like all banks should be

Deposit with Mobile Check Deposit

Open the Business Mobile Banking App, sign the back of your check, take a picture of it, and your deposit is a go.

Customization and agility

Helping you achieve your business goals and needs by diving deeper into your operations and cash flow, bringing ideas and

alternatives to the table.

Fees explained up front

We're honest about the cost of doing business, the same way you are with your customers. no surprises and no sneaky fine print.

Access your digital banking tools

Make deposits or ACH payments, transfer funds, check balances, set different access levels for employees, and more.

Geared toward sustainable success

While we're committed to meeting your needs

today, we also have one eye on the future. We're

here to build on your foundation and fuel growth.

Open communication

Alerts, secure messages, and a dedicated team of small business banking experts to guarantee satisfaction as best we can.

Enable alerts on account deposit(s), debit(s), low balance, incoming and outgoing wire payments, and more. Refine alert settings to your preferences.

Partnership and guidance

Let us help you navigate the surprising challenges and opportunities that growth brings, whether it's big picture or day-to-day.

Find

Us

Find

Us

Schedule one-on-one time with a banker.

Schedule one-on-one time with a banker. Equal Housing Lender - Member FDIC

Equal Housing Lender - Member FDIC