suppliers, our lending solutions help

you manage changes in cash flow.

Whether you’re looking to manage your working capital, improve cash flow to make a major purchase, or refinance debt, Santander’s dedicated team of small business banking experts can help maximize the momentum of your business. No matter the need, we have a flexible financing solution1.

Our flexible lending options include Small Business Administration (SBA) loans that may have smaller down payments and longer repayment terms than conventional bank loans, meaning lower monthly payments that help small to mid-sized businesses with cash flow. As a Preferred Lender under the SBA, Santander is approved to offer SBA loans and can help expedite the approval process for business owners.

| | Business Line of Credit | Term Loan | Commercial Real Estate Loans | Equipment and Vehicle Financing |

| This loan is great for | Short-term working capital financing needs | Financing needs requiring longer term to pay | Purchase, renovate, or refinance owner occupied commercial real estate | Financing new equipment or new and used vehicles |

| Length of loan | One year revolving term with annual renewals | Up to 5 years | Up to 25 years | Equipment: up to 7 years Vehicle: up to 10 years |

| Size of loan | Minimum: $10,000 Maximum: $500,000 | Minimum: $10,000 Maximum: $1,000,000 | Minimum: $25,000 Maximum: $1,000,000 | Minimum: $25,000 Maximum: $1,000,000 |

| One-time Fees Fee discounts available for eligible customers2 | $250 origination fee | 0.50% origination fee, minimum $250 | 1% origination fee; appraisal, potential environmental, and other customary real estate transaction charges | $395 one-time documentation fee |

| Annual Fee | $250 annual fee, charged on the anniversary of opening the Line of Credit | No Annual Fee | No Annual Fee | No Annual Fee |

| Collateral Requirements | Unsecured: $10,000 to $100,000 Secured3: $100,000 to $500,000 | Unsecured: $10,000 to $100,000 Fully-Secured: $100,000 to $1,000,000 | Up to 80% LTV | 1st PMSI/Title on asset being financed |

| Interest | Rate based on Santander Prime Rate discounts available for eligible customers2 | Fixed | Fixed rates. For 20- and 25- year terms, rates can reset every 5 or ten years | Fixed |

| Monthly Payment | Interest-only payments | Fixed monthly payments of principal and interest, fully amortizing (no balloons to refinance) | Fixed monthly payments of principal and interest, fully amortizing (no balloons to refinance) | Fixed monthly payments of principal and interest, fully amortizing (no balloons to refinance) |

| Time in Business | At least two years in business under current ownership structure. | At least two years in business under current ownership structure. | At least two years in business under current ownership structure | At least two years in business under current ownership structure. |

Schedule one-on-one time with a banker.

Schedule one-on-one time with a banker.

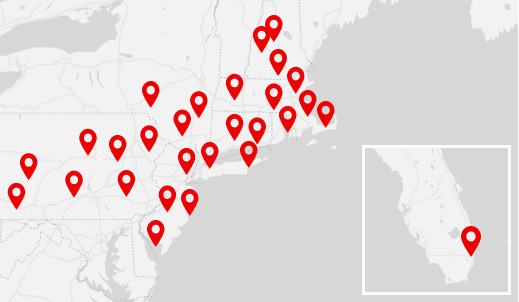

Find Us

Find Us