Small Business Administration (SBA) Loans | Santander bank - Santander

Small Business Administration (SBA) Loan

Find loans guaranteed by the SBA, designed to fuel expansion and profitability when traditional financing may not be an option.

Santander offers SBA Loans up to $500,0001

More of the capital you need to finance your biggest plans

Benefits of an SBA Loan compared to

conventional financing:

A preferred SBA lender

Santander provides the expertise and experience to find the right financing solution for your business needs

- Knowledge and expertise in SBA lending

- Extensive experience in navigating the ins and outs of SBA requirements

- Customized SBA Loans that meet your business unique needs

Small Business Administration

Loan features and benefits

Opportunity

Benefit from more flexible underwriting and repayment terms than traditional financing.

Flexible

Choose from multiple lending options for lines of credit, term loans, or real estate loans.

Terms

Longer terms available compared to traditional financing options.

Learn more about how the SBA helps small businesses at SBA.gov.

SBA Loans available for your business

Filter Products

| | SBA Express Line of Credit | SBA Express Term Loan |

| This loan is great for | Short-term working capital financing needs | Purchase of fixed assets, permanent working capital, refinance debt |

| Length of Loan | Revolving line of credit for five years, then fixed-term loan for five years | Up to 10 years |

| Size of Loan | Minimum: $10,000 Maximum: $500,000 | Minimum: $10,000 Maximum: $500,000 |

| One time Packaging Fee Fee discounts available for eligible customers2 | $250 | $250 |

| Annual Fee | No annual fee | No annual fee |

| Collateral Requirements | Unsecured: $10,000 to $100,000 Secured: $100,000 to $500,000 | Unsecured: ≤$100K Secured: >$100K; PMSI financed asset |

| Interest | Prime rate based: subject to SBA guidelines | Fixed rate subject to SBA guidelines |

| Monthly Payment | Interest-only payments for the first five-years, then fixed principal plus interest for the remaining five-year term period | Fixed monthly payments of principal and interest, fully amortizing (no balloons to refinance) |

| Time in Business | For-profit entities: at least 13 months in business under current ownership. Additional SBA approval required. | For-profit entities: at least 13 months in business under current ownership. Additional SBA approval required. |

Open account comparison

Increase your chances of being approved

Make payments on time

Paying down all your business debts on time is the single most important thing you can do to maintain a good credit score.

Show positive cash flow

Lenders will want to know that your daily operations are generating enough cash flow to repay your loan over time.

Use collateral

You can increase your chances for credit approval and extension by putting up collateral to secure your loan.

Understand the requirements to apply

Before you apply for a small business loan, take some time to review your personal credit history to ensure that you are in good standing.

Make a plan for your business loan

You need to be able to explain why your business needs a loan, how you will use the money, and when you plan to pay it back.

Gather your financial and legal documents

Lenders will require you to provide financial statements and legal documents to assess if your business is healthy and credible.

Completing your application

A loan officer will work with you directly to help gather all information you ll need to prepare your loan request.

The underwriting process

Next, a team verifies and analyzes the documents submitted to determine accuracy and creditworthiness.

Loan closing

A Loan Closer will contact you to review requirements for closing and finalizing the loan.

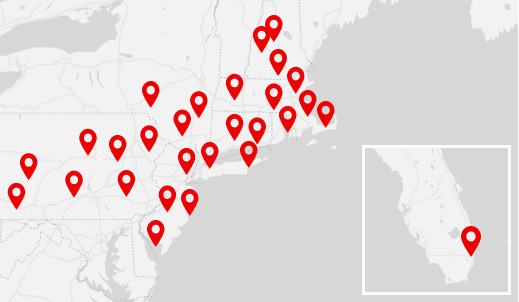

Find Us

Find UsBranches across the Northeast and in Miami, Florida, plus 2,000+ ATMs.

1All small business accounts, loans, and services are subject to individual approval and to the acceptance rules, credit limits, policies, and guidelines of Santander Bank, N.A. Small Business Administration (SBA) collateral and documentation requirements are also subject to SBA guidelines. Other terms and conditions apply. For more information on the SBA Preferred Lenders Program, connect to: https://www.sba.gov/.

Equal Housing Lender - Member FDIC

Equal Housing Lender - Member FDIC