Certificates of Deposit (CDs) - Santander

Certificates of Deposit

Annual Percentage Yield*

Product title

Annual Percentage Yield*

Product title

Annual Percentage Yield*

Product title

What are Certificates of Deposit?

And because you agree to invest your money for the entire term, Certificates of Deposit generally offer higher interest rates than savings or money market savings accounts.

How do you choose a Certificate of Deposit?

Penalties will apply if you withdraw the money before the end of the CD term.

Advantages of a Certificate of Deposit

- A wide variety of time frames

- Guaranteed rate of return

- Competitive rates

- Low-risk investment

Talk to a banker about our other Certificate of Deposit options. |

Find a branch |

Convenience in the palm of your hand

Just take a picture of your signed check while you’re on the go.

Pay bills, send money with Zelle®** , make transfers and more, all from the Mobile Banking App.

Create or update your PIN, update contact information, and report a lost or stolen card.

The trust you need to bank confidently

Only you can unlock your information with Touch ID® and Face ID® for Apple and fingerprint for Android.††

Shop online, in-store, or make bill payments with Santander PROTECHTION by your side.

For digital security, our firewalls protect all your information stored in our database.

Bank anywhere, anytime

Manage your account whenever and wherever you want with our Mobile Banking App.

Download our

Mobile Banking App

Unlock on-the-go features with our highly-rated Mobile Banking App.

Enroll in Santander

Online Banking

Manage your money securely by enrolling in Online Banking.

FAQs: CDs

CDs can only be opened in a branch. To open an account, you will need:

- Your Social Security number

- A government-issued ID

- A minimum deposit of $500

- A valid email address

Yes. There is a maximum of $250,000 of deposit insurance from the FDIC for each category of account ownership. Visit https://www.fdic.gov/ for more information.

- We calculate interest using the available daily balance method, which applies a daily periodic rate to the available daily balance in your account each day. Interest is generally calculated using a 365-day year.

- Interest on your CD is credited monthly. You may choose to have the interest credited to your CD, credited to another Santander checking, money market savings or savings account, or mailed to you by check.

Our most popular rates and terms are shown above. In addition to those rates featured above, speak with a Banker to learn more about our other savings options. Please note that published rates are subject to change without notice.

- The maturity date for a CD is the last day of the CD’s term.

- On the maturity date, your CD will automatically renew into the closest term available and the interest rate applicable to that term.

- On the maturity date and during the 10-calendar-day grace period following the maturity date, you will have the opportunity to complete the following:

- Choose a new CD term and rate

- Withdraw funds from the CD without penalty

- Add funds to the CD

- Close the account

- You will receive a renewal notice in the mail at least 20 days before your maturity date to remind you of these options.

Early Withdrawal Penalties for Personal and Business CDs

CD Terms Early Withdrawal Penalty Fees3-12 Months 3 months interest on amount withdrawn

13-48 Months 6 months interest on amount withdrawn

60 Months 12 months interest on amount withdrawn

Yes, you are allowed to have more than one signer on a CD account.

No, you will need to deposit all funds at the time you open your CD. You will have the opportunity to add funds on the maturity date or during the 10-calendar-day grace period following your CD maturity date.

How much could my savings be worth?

See how your deposits can contribute to greater savings over time.

Read more

Emergency savings

Are you prepared for an emergency? Discover the importance of emergency savings to your financial future.

Read more

Money market vs. savings

Learn about the differences between a money market savings account and a savings account to see which one is right for you.

Read more

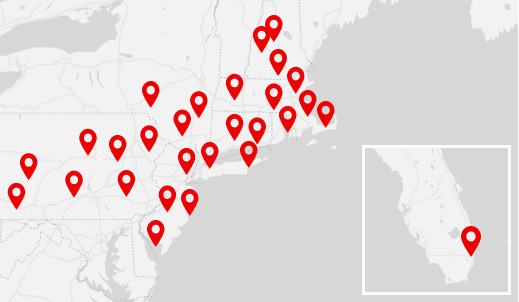

Find

Us

Find

Us

†There is a maximum of $250,000 of deposit insurance from the FDIC for each category of account ownership. Please visit fdic.gov for details.

**U.S. checking or savings account required to use Zelle®. Transactions between enrolled consumers typically occur in minutes and generally do not incur transaction fees. In order to send payment requests or split payment requests to a U.S. mobile number, the mobile number must already be enrolled with Zelle®. Zelle and the Zelle related marks are wholly owned by Early Warning Services, LLC and are used herein under license.

‡‡Digital Banking Guarantee: When you use Online Banking, we guarantee that your money is protected against online fraud or losses and that your bills will be paid on time. You are protected against unauthorized online transactions as long as you check your statement and promptly notify us of any unauthorized activity. Refer to your Digital Banking Agreement for details on guarantees and your responsibilities for promptly reporting unauthorized transactions, as well as a list of supported mobile devices.

Apple, the Apple logo, Apple Pay and Touch are trademarks of Apple Inc., registered in the U.S. and other countries. App Store is a service mark of Apple Inc., registered in the U.S. and other countries.

Schedule one-on-one time with a banker.

Schedule one-on-one time with a banker. Equal Housing Lender - Member FDIC

Equal Housing Lender - Member FDIC