Business Checking Account | Santander Bank - Santander

Business Checking

Account features

Business Checking offers many features that make your banking simpler and cost-effective.

Basic transactions1

Enjoy up to 300 basic transactions included with your account (per service fee period) at no charge.

Discount on checks

25% discount on your first order of business checks.

Cash deposit processing

No fee on cash deposit processing up to $10,000 each service fee period.

Waived Monthly Fees2

Your $15 Monthly Fee is waived if you do any one of the following within the service fee period:

- Maintain $5,000 average daily balance in the checking account, OR

- Maintain $10,000 in combined business deposit account balances with same ownership, OR

- Have three or more purchases using a Santander® Business Debit Mastercard® post into your account, OR

- Receive one or more Santander Merchant Services payments in your account, OR

- Incur $50 or more in cash management service fees

Business Checking account benefits

See how our business checking options compare

| | Business Checking | Business Checking Plus |

| Summary | An ideal everyday business checking solution | A premium account for larger businesses that can maintain higher balances. |

| Best if you have |

|

|

| Basic transactions1 included per Service Fee Period | 300, then $0.60 per transaction | 750, then $0.60 per transaction |

| Monthly Fee | $15 | $50 |

| Ways to waive Monthly Fee2 |

|

|

| Checkbook order | 25% off first check order | First check order free – up to $100 value |

| Cash Deposit Processing | No fee up to $10,000, then $0.27 per $100 of deposits | No fee up to $40,000, then $0.27 per $100 of deposits |

| | | |

The flexibility you need to do business while you're busy

We're here to support your unique small business

Forthcoming with our customers, like all banks should be

Deposit with Mobile Check Deposit

Open the Business Mobile Banking App, sign the back of your check, take a picture of it, and your deposit is a go.

Customization and agility

Helping you achieve your business goals and needs by diving deeper into your operations and cash flow, bringing ideas and alternatives to the table.

Fees explained up front

We're honest about the cost of doing business, the same way you are with your customers. no surprises and no sneaky fine print.

Access your digital banking tools

Make deposits or ACH payments, transfer funds, check balances, set different access levels for employees, and more.

Geared toward sustainable success

While we're committed to meeting your needs

today, we also have one eye on the future. We're

here to build on your foundation and fuel growth.

Open communication

Alerts, secure messages, and a dedicated team of small business banking experts to guarantee satisfaction as best we can.

Enable alerts on account deposit(s), debit(s), low balance, incoming and outgoing wire payments, and more. Refine alert settings to your preferences.

Partnership and guidance

Let us help you navigate the surprising challenges and opportunities that growth brings, whether it's big picture or day-to-day.

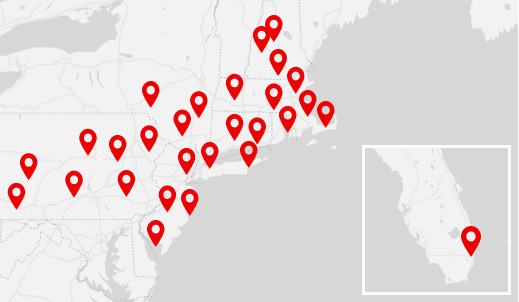

Book an appointment with a qualified banking expert

Let our dedicated team of local and online Small Business experts illuminate the road ahead, so you can see the smartest way forward.

Find

Us

Find

Us

2Avoid monthly maintenance fees by maintaining the required combined average daily balance in this account plus additional business checking and business money market savings (excluding commercial money market savings and certificates of deposit) owned by the same business entity. Only balances in these combined accounts owned by the same business entity can be considered when calculating the combined balance.

Equal Housing Lender - Member FDIC

Equal Housing Lender - Member FDIC