Personal Savings Accounts | Santander Bank - Santander

Santander savings options

Santander Select® Money Market Savings

Enjoy better rates and benefits with your Santander Select relationship*. Exclusively available to Santander Select® Checking account holders.

Santander® Money Market Savings

Grow your money faster, whether you’re saving for a rainy day or a nice vacation, with higher rates on higher balances.

Santander® Savings

Discover an easy way to start growing your savings and the perfect partner to your Santander checking account.

Certificates of Deposit

If you don't plan on tapping into your savings, then start earning interest on a fixed term with a guaranteed rate.

Looking for an elevated banking experience with unique privilege s

s and exclusive rates and benefits? Explore Santander® Private Cl

and exclusive rates and benefits? Explore Santander® Private Cl ient.

ient.

Compare Santander Savings Accounts

| Account | |||

| Monthly Fee‡ | $0 | $10 | $1 |

| How to waive the Monthly Fee‡ | Must own a Santander Select® Checking account in order to open. | Waived with any personal Santander® checking account or with a $10,000 average daily balance in the Santander® Money Market Savings account. | Waived with any personal Santander® checking account or with a $100 average daily balance in the Santander® Savings account. Additionally, the Monthly Fee is waived if any owner on the account is under age 26. |

| Interest earning? | Yes – Competitive rates | Yes – Competitive rates | Yes |

| Minimum opening deposit | $25 | $25 | $25 |

| ATM withdrawal fee§ (domestic non-Santander ATM) | $0 | $3 | $3 $0 if any owner on the account is under 26 years of age. |

| Free Paperless Statements? | Yes | Yes | Yes |

| Paper Statement Fee | $0 | $0 | $0 |

| Mobile Banking and Online Banking? | Yes | Yes | Yes |

Helping you save every step of the way

Our handy tools and services can help you understand when and how to reach your goals faster.

Direct Deposit to split your deposit between checking and savings

Set up alerts to manage your progress and stay on track

Mobile check deposit to easily make check deposits at your convenience

Interest calculator: How much will my savings be worth?

Savings goal calculator: How can I reach my goals with monthly deposits?

Bank anywhere, anytime

Manage your account whenever and wherever you want with our Mobile Banking App.

Download our

Mobile Banking App

Unlock on-the-go features with our highly-rated Mobile Banking App.

Scan QR code to open app. ![]()

Enroll in Santander

Online Banking

Manage your money securely by enrolling in Online Banking.

FAQs: Savings

All savings accounts can be opened in a Santander Bank branch and the Santander® Savings account can be opened online. Santander® Money Market Savings, Santander Select® Money Market Savings, and Santander® Private Client Money Market Savings accounts can only be opened online in conjunction with an online checking account opening. Certificates of Deposit and Individual Retirement Accounts can only be opened in branch. To open an account, you will need:

- Your Social Security number

- A government-issued ID

- Funds for an opening deposit

- A valid email address

As long as you have everything you need, applying for a savings account online should only take 15 minutes.

You will begin to earn interest as soon as the funds in the account are available in the bank.

Yes, you can open a savings account jointly in branch or online with anyone 18 years and older, or a child under the age of 18 if you are their parent or legal guardian. Learn more about joint savings and joint checking accounts.

Interest accrues daily and is credited to your account monthly.

How much could my savings be worth?

See how your deposits can contribute to greater savings over time.

Read more

Emergency savings

Are you prepared for an emergency? Discover the importance of emergency savings to your financial future.

Read more

Money market vs. savings

Learn about the differences between a money market savings account and a savings account to see which one is right for you.

Read more

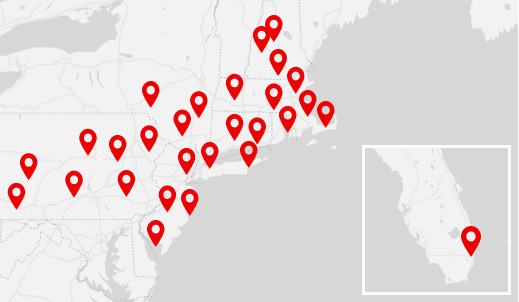

Find Us

Find Us

*Rates are available for new money market customers only. This is a variable-rate account and the rate applicable to your balance tier may change at any time without notice. Rate is available when account is opened within the residential ZIP code entered. Rates in other locations may vary. Fees may reduce earnings. A minimum deposit of $25 is required to open a Santander Select® Money Market Savings account. Personal accounts only. Must have or open a Santander Select® Checking account. All other fees apply. For more information about applicable fees and terms, refer to the Personal Deposit Account Fee Schedule or visit your local branch.

†Check with the IRS or a tax professional. Santander does not offer tax advice.

‡Per service fee period.

§Domestic ATMs are ATMs in the 50 United States, the District of Columbia, and Puerto Rico. ATM owner may charge a separate fee.

Apple, the Apple logo, Apple Pay and Touch are trademarks of Apple Inc., registered in the U.S. and other countries. App Store is a service mark of Apple Inc., registered in the U.S. and other countries.

Schedule one-on-one time with a banker.

Schedule one-on-one time with a banker. Equal Housing Lender - Member FDIC

Equal Housing Lender - Member FDIC