In-depth understanding of the global economy

Investing Overview - Santander

Welcome to Santander

Investment Services

Globally diversified funds and

comprehensive portfolios

Partnerships with some of the largest and most experienced fund managers in the industry

Put a complimentary financial plan to work for you

Investment strategies for every journey

No matter where you are in your pursuit of wealth, we can help you reach your goals.

Starting out

Her goals :

- Start saving for retirement

- Build an emergency fund

- Manage and reduce debt

- Invest aggressively in a diversified fashion

How Santander can help:

- We create plans to help diversify savings and investment assets

- We help assess investment opportunities and risks

- We offer guidance to help improve cash flow and pay off debt

Solutions

- Retirement accounts

- Savings accounts

- Insurance

- Debt consolidation

Building wealth

Their goals:

- Accelerate retirement to do more with life

- Upgrade to a bigger home

- Prepare for any unexpected problems

How Santander can help:

- We provide comprehensive financial planning

- We can help shape plans for tax-efficient investing

- We help create opportunities for greater retirement contributions

Solutions

- Retirement accounts

- Emergency liquid savings

- Advisory accounts

Preparing for the future

Their goals:

- Create an income from retirement savings

- Adjust risk tolerance and asset allocation

- Create a legacy through charitable contributions and passing wealth to heirs

- Plan for management of finances in the event of incapacitation

How Santander can help:

- We can advise on how to better balance risk tolerance

- We help build strategic and tax-efficient income streams

- We can help plan for the "what ifs" in life

- We can help create and manage the transfer of wealth

Solutions

- Insurance

- Advisory accounts

His goals:

- Protect the business against the unexpected

- Capitalize on success and grow personal wealth

- Build a solid retirement plan

- Build a plan for replacing business income with investment income

- Create an exit strategy

How Santander can help:

- We can help diversify assets beyond the business

- We can help create strategies to balance financing growth vs. leveraging liquid assets, as well as managing the tax implications

- We help ensure your liability and key person insurance plans are adequate for every eventuality

- We can help establish a reliable business continuity plan

- We can assist in implementing the right retirement plan for the business

- We can help draw up an effective succession plan

Solutions

- Insurance

- Retirement accounts

- Buy sell agreements

Work 1-on-1 with a Financial Advisor

Investment services to

help meet your goals

Asset allocation: We’ll help you build investment strategies to balance risk with the potential for better returns.

Managed investment strategies: Keep up with your financial strategy with additional assistance from experienced experts. This requires an initial minimum investment of $25,000.

Mutual funds: We partner with the largest and most experienced fund managers in the industry to give you access to a variety of funds that cover a range of markets, opportunities, and risk tolerances.

Income planning: We offer investment securities that can pay a fixed interest or dividend until their maturity date.

Insurance: We can assist you with strategies to help protect you and your loved ones.

Annuities: We offer investment options that protect against uncertainties like market performance and inflation rates.

Retirement planning: Create a personal or business retirement plan to help create security for yourself or for your employees.

College funding: Set up a 529 education savings plan, which may offer a tax-advantaged way to finance higher education costs.

Portfolio management: Help build a diversified portfolio to help meet your goals and match your risk tolerance.

Income planning: Create a strategy that considers tax implications and shields your lifetime earnings.

Access global market insights to inform

your long-term financial strategy

Read our quarterly in-depth analysis from global investment experts on financial markets and economic trends.

Financial advice to reach your goals faster

Income Earners

FAQ: Investments

A financial plan is a personalized roadmap for achieving your financial goals and it’s an important tool to help keep your investments on track. At Santander, we conduct a comprehensive analysis of your current financial situation, then we’ll work with you to create a plan for your goals, whether it’s for a big purchase, securing your retirement, or for growing your rainy-day fund. Your plan will highlight ways to reach your goals, like reducing spending, changing your investment strategy, or saving more.

A personalized plan can cover a range of concerns, including generational wealth transfer, investment planning, incapacity planning, education funding and income planning. It will also consider your prioritized goals, such as building a tax efficient income plan or creating a custom investment strategy based around personalized risk levels.

We review your plan to analyze the projected data and determine your current financial situation. This allows us to advise you on your roadmap. It also helps us make specific recommendations. For instance, if your current portfolio is concentrated in one specific market sector, a recommendation might be to diversify the portfolio to reduce risk.

Finally, it helps us to conduct annual reviews with you, to track your progress. Changes in your life today often will change your goals for tomorrow. It’s important to continually update your plan to ensure your goals and concerns are being addressed.

Yes, you choose whether you want to focus on income or growth with your investment dollars, or a combination of both. A Financial Advisor can show you various ways to assist with this goal.

- Assets: Financial statements from investment accounts, bank account detail information

- Liabilities: Outstanding debt obligations, mortgage, HELOC, student loan, personal loan, car loans

- Monthly payments: Broken down by principal and interest

- Income: Pre-retirement: salaries, rental income, etc.

- Retirement Income: Social Security payments, pension payments, etc.

- Expenses: What are your current monthly expenses? Will these expenses increase during retirement (travel, moving, etc.)?

Yes, our Financial Advisors are fully licensed to provide insurance advice and alternatives appropriate for your family and your goals.

Among the potential benefits:

• Being prepared for the "what ifs" of life

• Realistic retirement expectations

• Personalized financial planning

• Tax-efficient wealth transfer*

Investing involves risk. Your Santander portfolio is based in part on your comfort with, and ability to tolerate, risk. For example, you may have a high comfort with risk (you’re okay with big market downturns while seeking a better return in the long run). Alternatively, because of your income, spending needs, or age, you may not be able to tolerate big market swings. Santander Investment Services offers investments that are appropriate for many different risk tolerances. Your Financial Advisor will take your risk tolerance into consideration when making investment recommendations.

A Financial Advisor can advise on the appropriateness of various retirement plans. Santander Investment Services offers a traditional individual retirement account (IRA), Roth IRA, rollover IRA (for funds rolled over from a former employer’s 401(k) or 403(b) plan), and SEP IRA. Your Financial Advisor will review your personal financial situation and consider things like the appropriateness of tax-advantaged investment accounts*.

Yes, you can set up automatic monthly contributions to your investment account from linked bank account(s). This is one way to help continue growing your money and may reduce the effort required to meet your financial goals.

You can access your investment account documents, including your tax documents, through Santander Online Banking or by calling us at 866-736-6475.

Santander Investment Services Line

Santander Investment Services Line9 a.m. – 5 p.m. Eastern Time, Mon-Fri.

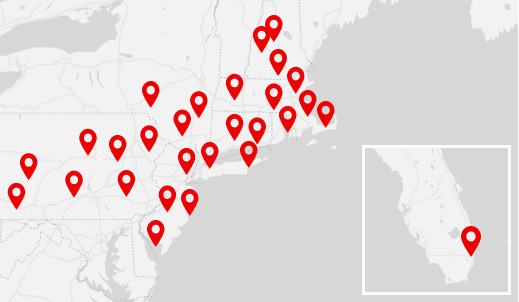

Find Us

Find Us

Useful links and contacts

BrokerCheck

Research the background of brokers and brokerage firms for more informed decisions when choosing a broker.

Accessibility service

Customer Service: 866-736-6475 Hearing- and speech-impaired customers may access that number via relay service by calling 7-1-1 or their preferred relay service.

Customers with disabilities who wish to receive statements in alternative formats, such as large print statements, may call Customer Service at 866-736-6475.

Accommodations at branch locations

Customers with disabilities who may require other accommodations at branch locations may contact Santander Bank's Customer Service Center at 877-768-2265. Hearing- and speech-impaired customers may call 7-1-1 or their preferred relay service.

Securities and advisory services are offered through Santander Investment Services, a division of Santander Securities LLC. Santander Securities LLC is a registered broker-dealer, Member FINRA and SIPC and a Registered Investment Adviser. Insurance is offered through Santander Securities LLC or its affiliates. Santander Investment Services is an affiliate of Santander Bank, N.A.

| INVESTMENT AND INSURANCE PRODUCTS ARE: | |||||

| NOT FDIC INSURED | NOT BANK GUARANTEED | MAY LOSE VALUE | |||

| NOT INSURED BY ANY FEDERAL GOVERNMENT AGENCY | NOT A BANK DEPOSIT | ||||

Santander Securities LLC U.S. registered representatives may only conduct business with residents of the states in which they are properly registered. Please note that not all of the investments and services mentioned on this website are available in every state.

The content on this website is intended for information /educational purposes only and should not be construed as investment advice, a solicitation, or a recommendation to buy or sell any security or investment product. The information on this website does not constitute either tax or legal advice. Investors should consult with a financial, tax, or legal professional regarding their individual situation.

Investments are subject to risk, including the loss of principal. Because investment returns and principal values fluctuate, shares may be worth more or less than their original value. Some investments are not suitable for all investors, and there is no guarantee that any investing goal will be met. Past performance is no guarantee of future results.

Third-party links are provided to you as a courtesy. We make no representation as to the completeness or accuracy of information provided at these websites. Information on such sites, including third-party links contained within, should not be construed as an endorsement or adoption by Santander Securities LLC or Santander Investment Services of any kind.

SSLLC is registered with the Securities and Exchange Commission ( SEC ) and Municipal Securities Rulemaking Board. An investor brochure that describes the protections available under MSRB rules and instructions on how to file a complaint with an appropriate regulatory authority can be found on the MSRB website at www.msrb.org.

Diversification does not assure an investor a profit nor does it protect against market loss.

Equal Housing Lender - Member FDIC

Equal Housing Lender - Member FDIC